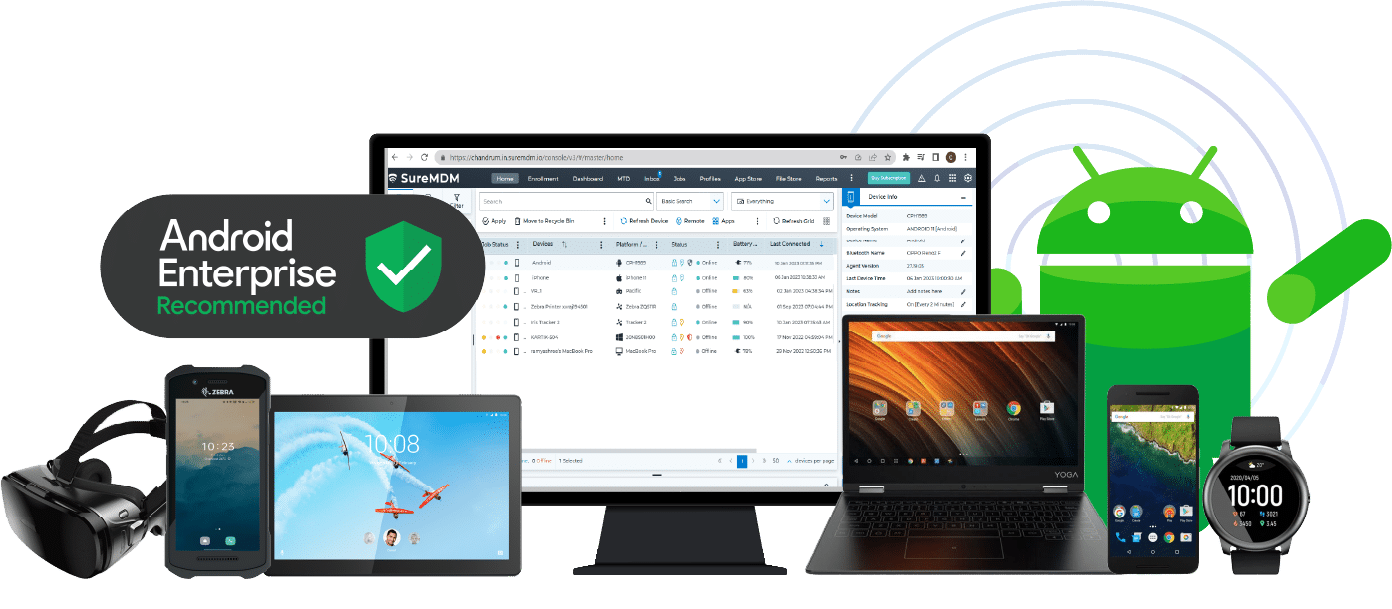

Android Enterprise Solutions

Contact us

Mobile Application Management

Contact us

IT Service Management

Contact us

Software Asset Management

Contact us

Endpoint Protection / IT security

Contact us

Software Distribution

Contact us

Inventory Management

Contact us